advantages and disadvantages of llc for rental property

THE ADVANTAGES AND DISADVANTAGES TO. Profits subject to social security and medicare taxes.

Should I Transfer The Title On My Rental Property To An Llc

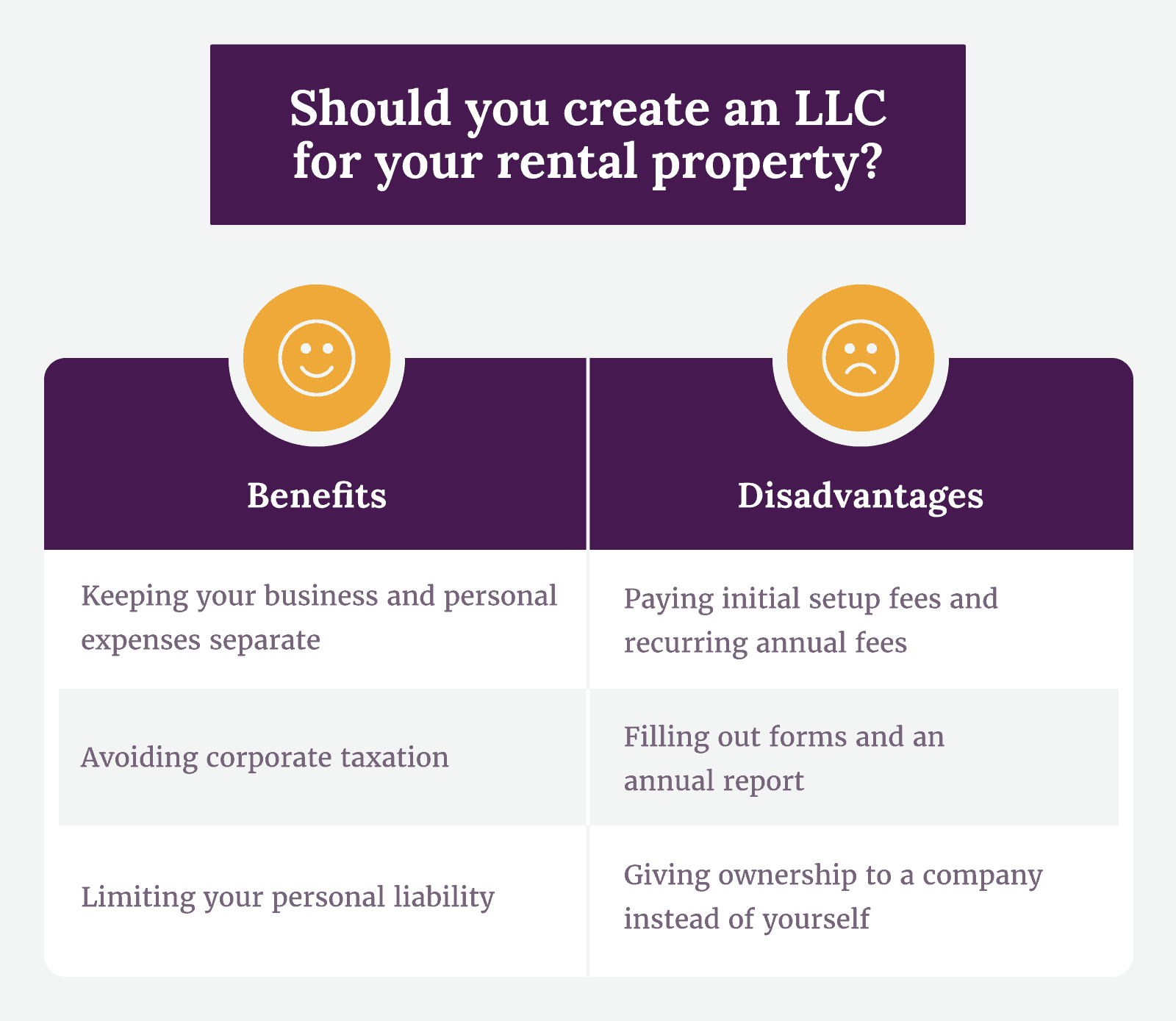

Some of these benefits include.

. Benefits of Creating an LLC. With a corporation only salaries and not profits are subject to such taxes. There is a fee to create an LLC and most states charge an annual registration fee.

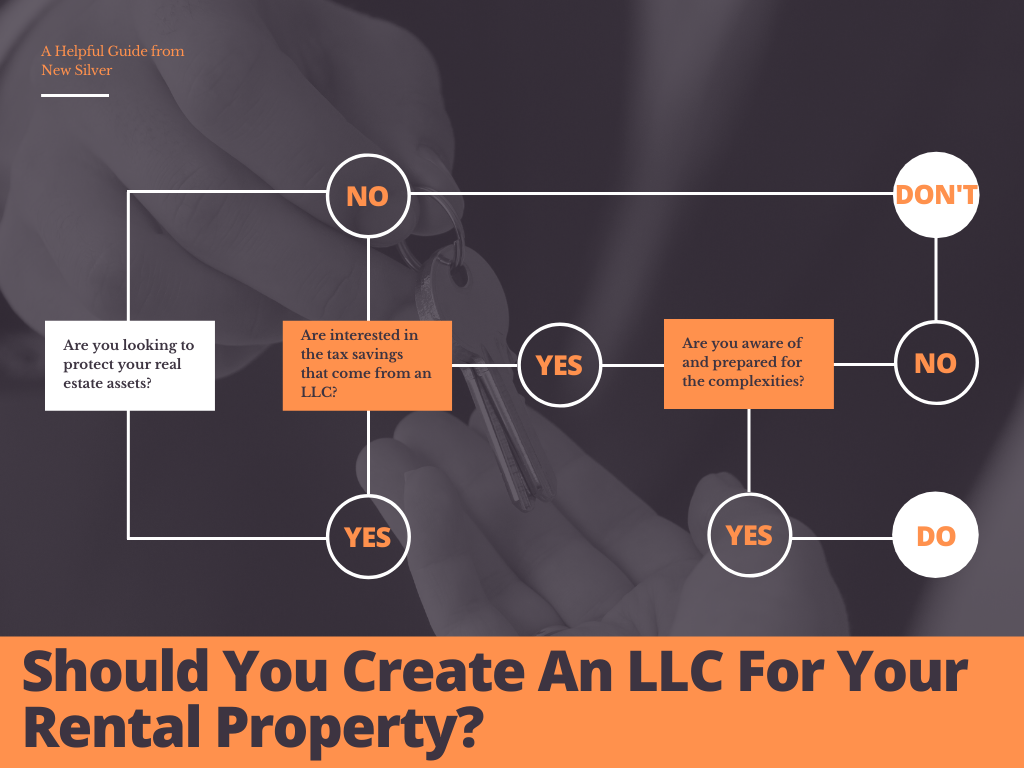

Reduce liability If one series gets sued other series arent liable. As the owner of a rental property at some point you might wonder whether you should hire a property manager or take care of your property yourself. Potential to deduct mortgage interest and rental income.

While owning rental property is an excellent way to invest capital many investors also buy. Yes you may have liability insurance but if someone is seriously injured on your property they can sue you personally for medical expenses and damages above and beyond the limits of your policy. Here are some of the benefits of investing in rental properties.

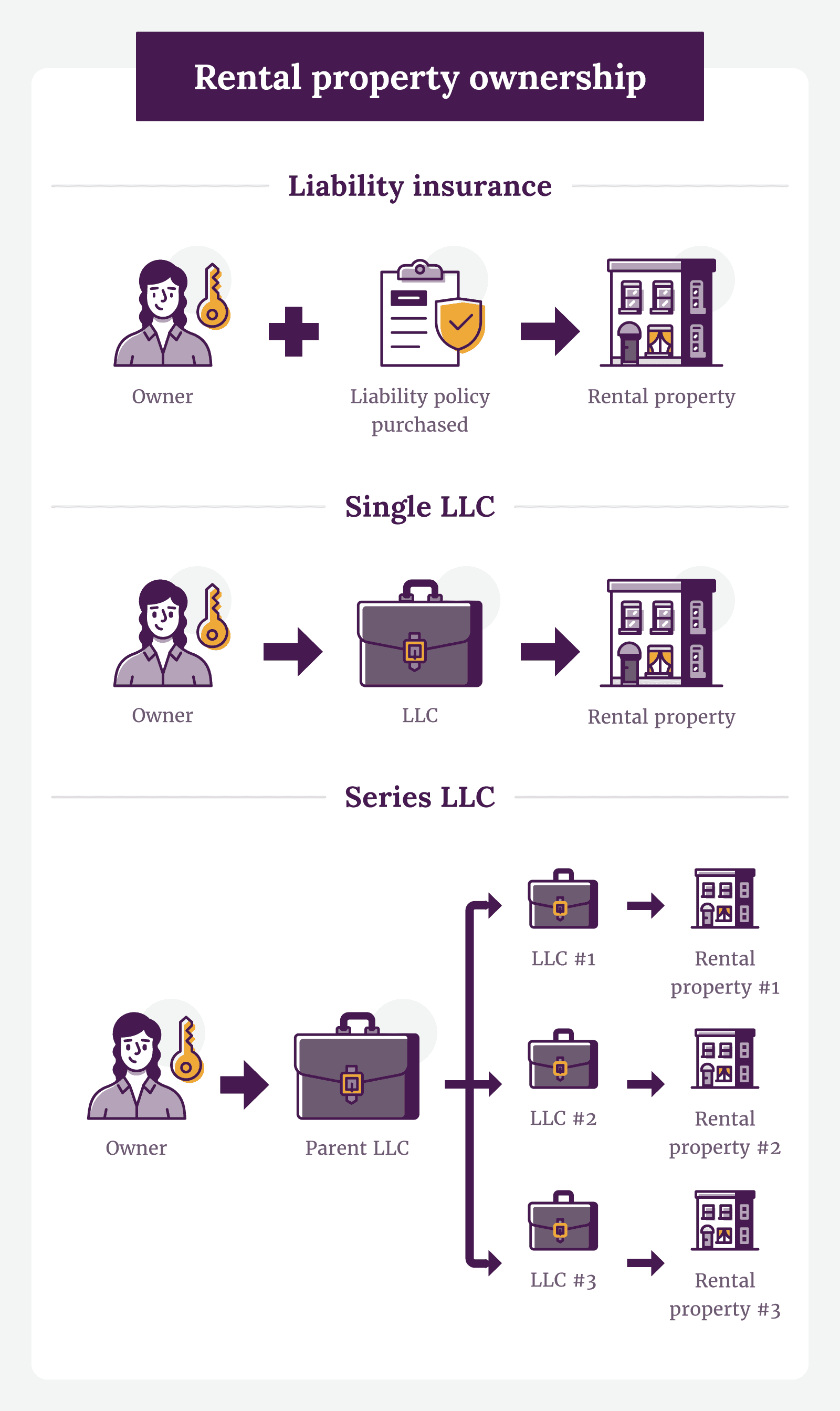

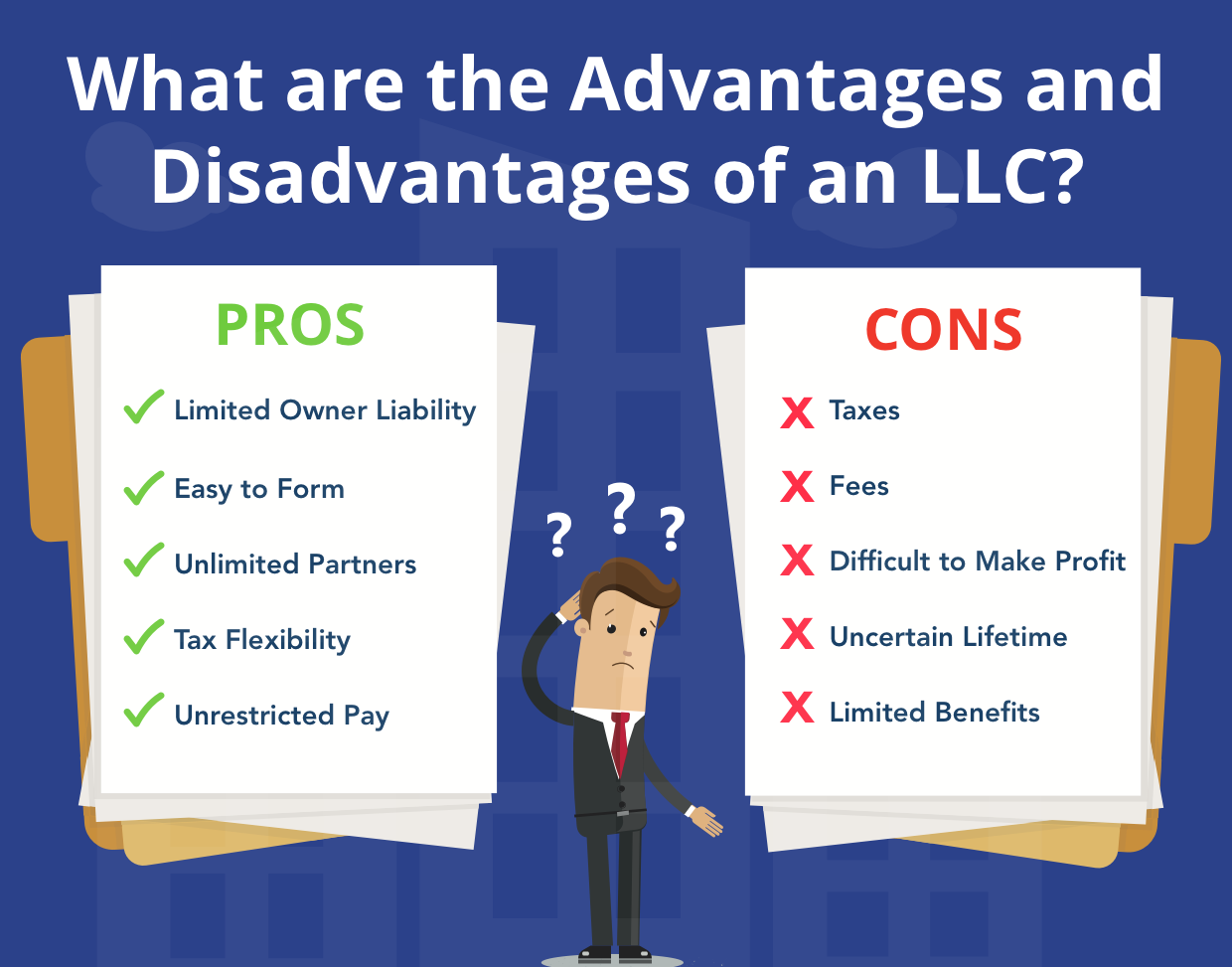

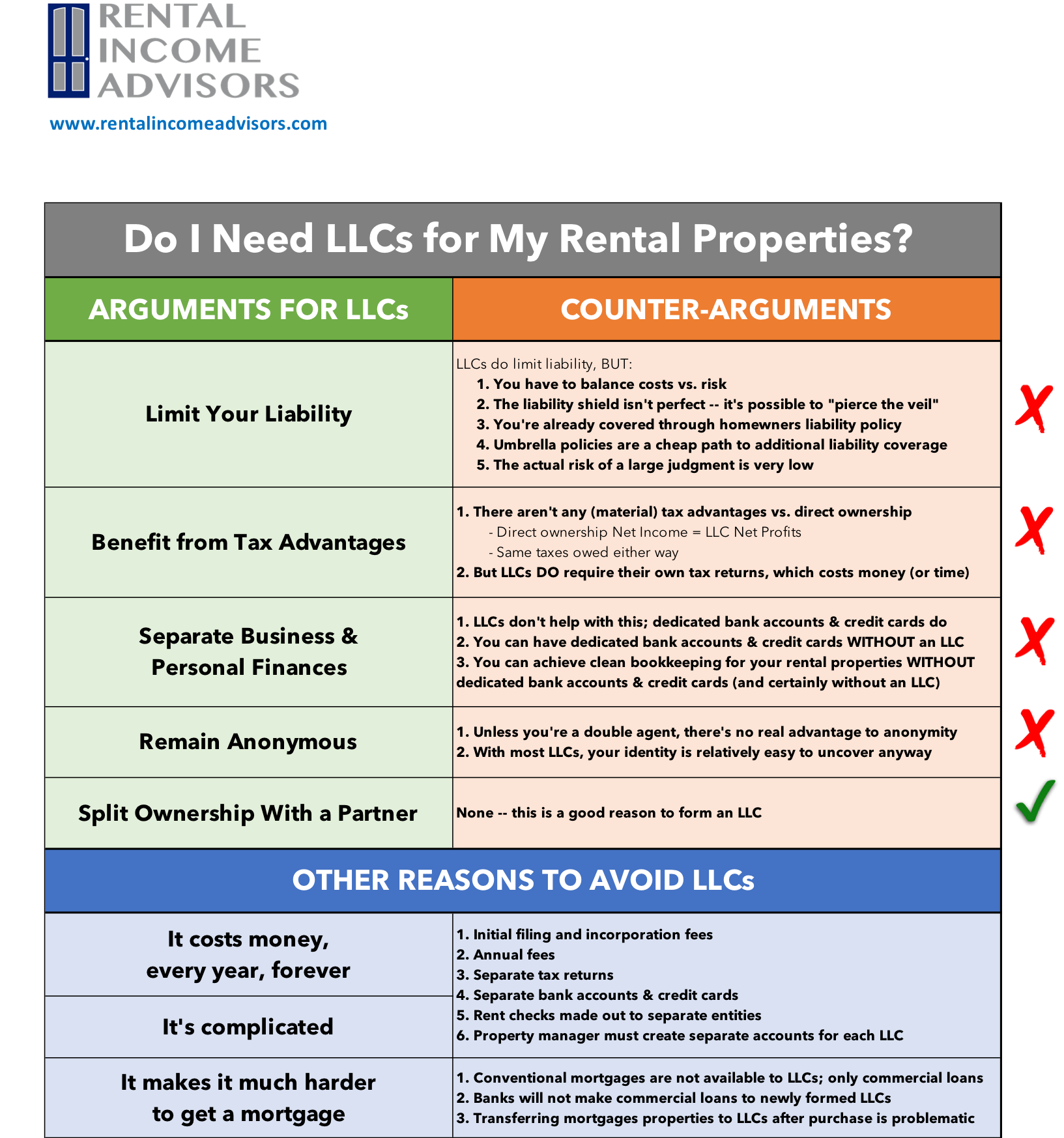

The biggest benefit of creating an LLC for your rental property is that it can insulate you from personal liability. Disadvantages of a Real Estate Limited Liability Company Fees Fees and More Fees While a real estate LLC allows you to save money from tax deductions there are costs associated with forming an LLC as well as fees for keeping it in a good legal standing. Drawbacks to using an LLC include possible self-employment tax difficulty of financing and annual fees.

While there are some benefits to buying a rental property through an LLC there are also some drawbacks. Check out our Self Filing Option. For many years lawyers financial advisors and tax accountants have been teaching asset protection to rental property owners.

Here are the three potential drawbacks of this solution. Utilizing LLCs can impact your financing. 1 million customers served.

Three Cons of Using an LLC for Single Family Rental Properties. One of the disadvantages of using an LLC for a real estate rental business is the cost. These costs are.

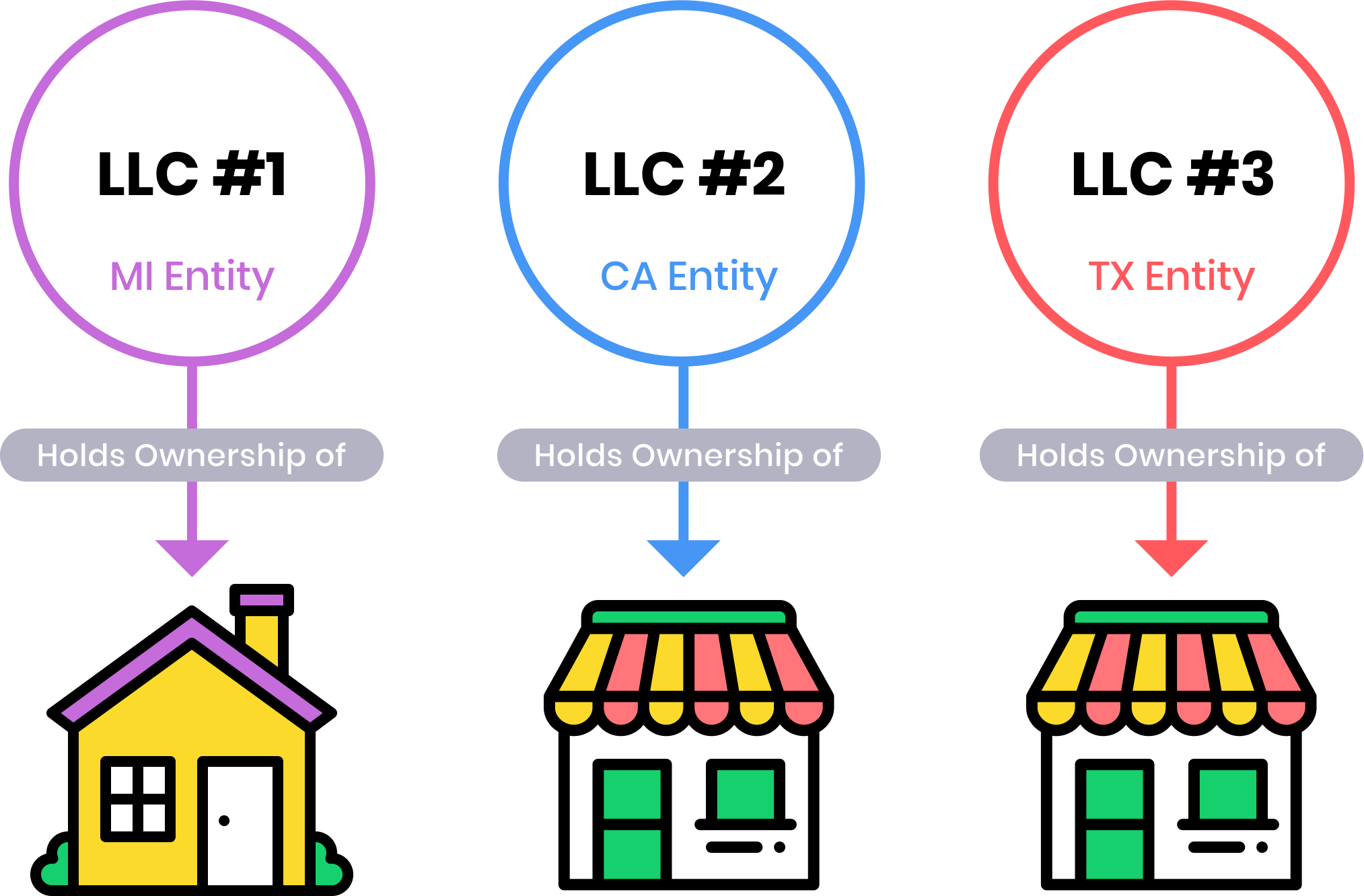

To form a LLC and transfer to it our vacation home on Tahoe which is now in our revocable living trustwhat are the advantages and disadvantages Thank you very much much. The series LLC structure can benefit real estate investors with multiple properties in several ways. There are various fees involved with setting up and maintaining an LLC which will vary by state.

To create an extra. Even with the above advantages to using an LLC for single family rental properties no solution is completely perfect. In some circumstances owners of an LLC may end up paying more taxes than owners of a corporation.

Advantages of a Series LLC for Real Estate Investments. For example if someone falls and. The possible downside here is that accrued depreciation must be subtracted from the purchase price also called basis of the property translating into a higher capital gain on the final sale.

The main reason investors prefer to have their rental properties in an LLC is for asset protection. The drawbacks of having rental properties include a lack of liquidity the cost of upkeep and the potential for difficult tenants and for the neighborhoods appeal to decline. ReAdvantagesDisadvantages of Setting up LLC for Rental Properties.

It Costs Money to Register an LLC for Single Family Rental Properties. One person can create one or multiple property owners can become members of. Other business ownership structures such as a corporation or partnership.

For property owned more than a year youll pay the lower long-term capital gain rate. LLCs do cost money. What are the Advantages and Disadvantages of Buying Rental Properties.

Advantages of Rental Properties. This is the dream that most people have when they look into buying rental properties. Managing a rental takes lots of work much more than many people realize.

If you sell rental property youll pay tax on any capital gain realized. Only if the properties had no mortgages and the titles would also be owned by said LLC. The aforementioned benefits come.

Find the Most Straightforward LLC Service. Cheaper state registration fees. Tax Disadvantages Advantages of Rental Property.

Most traditional residential loans and mortgages for rental. Using a limited liability company to protect your rental properties has many advantages but a few disadvantages too. LLCs provide no protection if the mortgage is held by you.

Up to 20 cash back If we are purchasing property that has rental potential what are the advantages of purchasing the property in an - Answered by a verified Real Estate Lawyer. Salaries and profits of an LLC are subject to self-employment taxes currently equal to a combined 153. The Advantages and Disadvantages of titling your Rental Properties into an LLC.

Greater flexibility ie. Benefits of an LLC for Rental Properties. Forming an LLC Shouldnt Be Complicated.

Distribution of profits and transferring interest rights. By setting up each property as its own series in a series LLC investors can. Most discussions of the tax advantages of an LLC for your rental properties are quite misleading because they tell you why an LLC is advantageous vs.

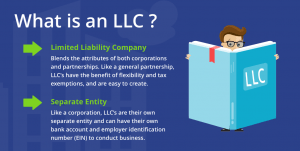

Three advantages to using an LLC for rental property are pass-through of income and losses protecting personal assets and creating a flexible ownership structure. The owner of an LLC Limited Liability Company is a member of that company and there is no minimum number of members required to form an LLC. Ad Form a New York LLC Online in 3 Easy Steps.

Pass-through tax advantages. If your property is owned by an LLC. Ad Compare the Best LLC Formation Services and Find the Right One For Your Business.

An LLC for rental property can be a single-member LLC or have multiple members. If thats the case get a giant umbrella policy to protect your liability. Buying a rental property as an LLC often requires more in fees a higher down payment and operating expenses.

They cite things such as pass-through taxation avoiding double-taxation simpler record-keeping and filing rules and so on.

Llc In Nyc Real Estate Pros And Cons Nestapple New York

23 Pros And Cons Of Using Llc For A Rental Property Brandongaille Com

Should You Put Rental Properties In An Llc White Coat Investor

Llc In Nyc Real Estate Pros And Cons Nestapple New York

12 Reasons To Use An Llc For Rental Property Under 30 Wealth

Benefits Of Buying A Rental Property Through An Llc Avail

Llc For Rental Property Pros Cons Explained Simplifyllc

Should You Form An Llc For Rental Property 2022 Bungalow

Advantages And Disadvantages Of Owning Rentals In An Llc

20 Pros And Cons Of Creating An Llc For Your Rental Property

Llc For Rental Property What Should Real Estate Investors Do

Llc In Nyc Real Estate Pros And Cons Nestapple New York

Llc In Nyc Real Estate Pros And Cons Nestapple New York

Should You Put Your Rental Property In An Llc Truic

Why You Probably Don T Need An Llc For Your Rental Properties Rental Income Advisors

Should You Create An Llc For Rental Property Pros And Cons New Silver

20 Pros And Cons Of Creating An Llc For Your Rental Property